Non-Profit

What would happen if one of your not-for-profit’s key people suddenly quit or had to go on long-term disability? Would you be able to conduct business as usual? To prevent a critical function from possibly coming to a standstill, consider cross-training staff. Organization benefits Cross-training personnel means that you teach them how to do one…

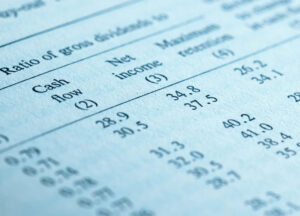

Read MoreDeclining donations, dues, grants or sponsorship funds may lead to not-for-profit budget deficits. But you can reduce the risk of cash flow crunches by making relatively minor changes to your cash management practices. Expedite receipts The sooner your organization accumulates cash, the better your cash flow. For example, consider moving your fundraising calendar ahead. By…

Read MoreYour not-for-profit can’t generally reimburse employees for business expenses tax-free just because staffers submit expense records. However, you can if you have a properly executed accountable plan. Under such a plan, reimbursement payments will be free from federal income and employment taxes for recipient employees and not subject to withholding from their paychecks. Additionally, your…

Read More- « Previous

- 1

- 2

- 3